BTC Price Prediction: Analyzing Technical Patterns and Fundamental Drivers Through 2040

#BTC

- Technical Strength: BTC trading above key moving averages with healthy Bollinger Band positioning suggests underlying bullish momentum

- Institutional Adoption: Major corporate investments and ETF growth demonstrate increasing institutional confidence in Bitcoin's long-term value proposition

- Macroeconomic Tailwinds: Changing economic outlook and infrastructure investments create favorable conditions for digital asset appreciation

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Averages

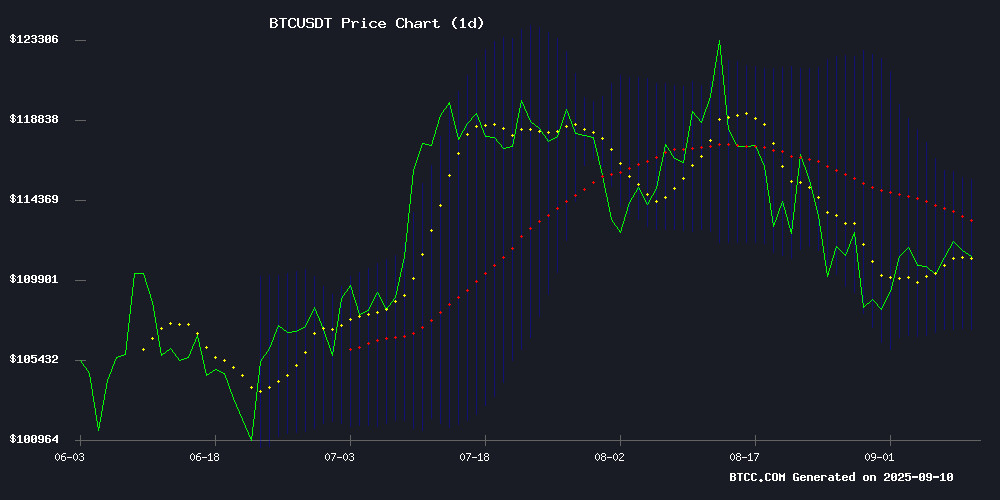

BTC is currently trading at $113,199, comfortably above its 20-day moving average of $111,436, indicating sustained bullish momentum. The MACD reading of 1,474.17 versus the signal line at 2,626.82 shows some near-term consolidation, though the negative histogram suggests potential for short-term pullbacks. Trading within the Bollinger Bands range of $107,163 to $115,708 positions BTC in a healthy upward channel, with the current price approaching the upper band resistance level.

According to BTCC financial analyst Mia: 'The technical setup suggests BTC is building strength for another leg higher. Holding above the 20-day MA is crucial for maintaining the bullish structure, while a break above $115,708 could trigger accelerated momentum toward new highs.'

Market Sentiment: Institutional Adoption and Regulatory Developments Drive Optimism

Multiple bullish catalysts are converging in the cryptocurrency space. Microsoft's $17.4 billion AI infrastructure deal is fueling crypto mining stocks, while Metaplanet's $1.4 billion share sale for Bitcoin treasury expansion signals growing corporate adoption. The labor market update altering economic outlook and CoinShares Bitcoin Mining ETF hitting record highs demonstrate institutional confidence.

BTCC financial analyst Mia notes: 'The combination of institutional investment, corporate treasury strategies, and infrastructure developments creates a fundamentally strong backdrop for Bitcoin. While regulatory scrutiny continues with cases like Athena Bitcoin's undisclosed fees, the overall sentiment remains constructive as traditional finance increasingly embraces digital assets.'

Factors Influencing BTC's Price

Antelope Enterprise Stock Surges 355% Amid Retail Trader Frenzy and Bitcoin Speculation

Antelope Enterprise Holdings (AEHL) shares skyrocketed 355% in pre-market trading Wednesday, extending a 5.73% gain from the previous session. The dramatic move comes without apparent fundamental triggers—no SEC filings or corporate announcements explain the parabolic rise.

Market observers point to two plausible drivers: a coordinated retail trader campaign resembling recent pump-and-dump patterns seen in Chinese holding stocks, or speculative positioning ahead of the company's planned $50 million Bitcoin treasury initiative. Streeterville Capital's July commitment to fund BTC acquisitions appears to be drawing crypto-oriented investors, despite zero actual Bitcoin purchases to date.

Vietnam Unveils Statue of Bitcoin Creator Satoshi Nakamoto

Vietnam has joined an exclusive group of nations honoring Bitcoin's enigmatic creator with the unveiling of a Satoshi Nakamoto statue in Hanoi. The monument, housed within Vietnam's first permanent blockchain exhibition space, signals the country's growing ambition in Web3 innovation.

Italian artist Valentina Picozzi's design captures Bitcoin's decentralized ethos through an optical illusion—the solid bronze figure dissolves when viewed head-on. This artistic choice mirrors Nakamoto's disappearance and Bitcoin's leaderless architecture.

The Blockchain Gallery hosting the statue will serve as an educational hub, with plans for nationwide replication. Vietnam Blockchain Association's Phan Duc Trung emphasizes the initiative aims to demystify distributed ledger technology for mainstream adoption.

Risk-On Positions Undermined by 1M U.S. Jobs Revision: Crypto Daybook Americas

The U.S. Bureau of Labor Statistics revealed a staggering revision: nearly 1 million fewer jobs were created in the year ending March than initially reported. This casts doubt on earlier optimism about labor market strength and undermines risk-on positions taken by traders over the past year.

Markets interpreted the downward revision as a signal for aggressive Fed easing, with one Polymarket trader betting on a 50-basis-point rate cut by September. Bitcoin traded above $112,000 after dipping to $110,800 during North American hours, while European stocks rallied and S&P 500 futures pointed to a positive open.

Caution remains warranted. Upcoming U.S. producer and consumer price indices may show persistent inflation well above the Fed’s 2% target, potentially reigniting stagflation fears and weakening the case for rate cuts. Liquidity tightening adds another layer of uncertainty.

CoinShares Bitcoin Mining ETF Hits Record High as AI Stocks Extend Rally

The CoinShares Bitcoin Mining ETF (WGMI) surged 12% to a record $33.13 on Tuesday, buoyed by Nebius Group’s $17.4 billion GPU supply deal with Microsoft. The ETF has gained 44% year-to-date, eclipsing its debut price of $30. Top holdings IREN and Cipher Mining have skyrocketed 188% and 90%, respectively, in 2024.

AI-driven momentum continues to fuel the crypto mining sector. Oracle’s pre-market shares jumped 30% Wednesday after raising its cloud revenue growth forecast to 77%, with backlog swelling to $455 billion on AI demand. The Nebius-Microsoft agreement has become a catalyst for both AI and mining stocks, reflecting growing institutional interest in blockchain infrastructure.

DC Attorney General Sues Athena Bitcoin Over Undisclosed Crypto ATM Fees and Fraud

Washington, D.C. Attorney General Brian Schwalb has filed a lawsuit against Athena Bitcoin, operator of Bitcoin ATMs (BTMs), alleging hidden fees and failure to prevent fraud. The complaint claims 93% of deposits at Athena's D.C. machines from May to September 2024 were tied to scams, with median losses of $8,000 per transaction—primarily affecting elderly victims.

The lawsuit accuses Athena of charging up to 26% in undisclosed transaction fees, masked as a 'Transaction Service Margin' in its terms. One victim reportedly lost $98,000 through the company's machines. The firm's no-refund policy allegedly prevented recovery of stolen funds.

This case emerges amid global scrutiny of crypto ATM operators. Regulatory bodies are increasingly targeting companies that facilitate financial crimes through inadequate anti-fraud measures. The action underscores growing institutional focus on consumer protection in cryptocurrency transactions.

KindlyMD's Nakamoto Invests $30M in Japan's Bitcoin-Centric Metaplanet

KindlyMD's subsidiary Nakamoto has committed $30 million to Metaplanet's global equity offering, marking its largest single investment to date. The Tokyo-listed firm, Japan's first public company to adopt Bitcoin as a primary treasury asset, will use the capital to expand its BTC holdings.

Metaplanet recently purchased an additional 136 BTC for $15.2 million, bringing its total stash to 20,136 BTC—ranking sixth globally among public companies. The deal coincides with Metaplanet's shareholder-approved capital restructuring, which introduced dual-class shares and increased authorized stock to 2.7 billion.

"Metaplanet's Bitcoin-focused strategy has positioned it as Japan's corporate crypto leader," said KindlyMD CEO David Bailey. The investment underscores growing institutional confidence in Bitcoin's role as a treasury asset.

Peter Brandt Criticizes Robinhood’s New “Multiple Accounts” Feature

Robinhood's latest feature, enabling users to segment portfolios by asset type or strategy, has drawn sharp criticism from veteran trader Peter Brandt. The tool, designed to offer organizational flexibility, allows separate accounts for long-term Bitcoin holdings, short-term trades, or thematic investments like AI stocks.

Brandt, active in markets since the 1970s, lambasted the update on X, sarcastically calling it "the best part." His concern centers on potential misuse—traders could selectively showcase profitable accounts while obscuring losses, creating a veneer of consistent success.

The feature risks amplifying social media's toxicity, Brandt warned. Platforms like X and YouTube may flood with cherry-picked "winning" account screenshots, misleading novice investors seeking guidance. While the tool aids genuine portfolio management, Brandt's critique underscores how fragmented visibility distorts reality.

Metaplanet to Raise $1.4B in Share Sale for Bitcoin Treasury Expansion

Metaplanet (3350), Japan's leading Bitcoin treasury firm, announced plans to raise 204.1 billion yen ($1.4 billion) through an international share offering. The Tokyo-based company, already holding 20,136 BTC—the sixth-largest corporate stash globally—priced 385 million new shares at 553 yen each. Its stock surged 16% to 714 yen on record volume.

Nakamoto Holdings (NAKA), advised by former Trump crypto consultant David Bailey, committed to purchasing $30 million of the offering. NAKA shares rallied 77% following the announcement. Metaplanet will allocate 183.7 billion yen to additional BTC acquisitions this autumn, with 20.4 billion yen earmarked for Bitcoin yield-generation strategies.

Crypto Mining Stocks Rally on Microsoft's $17.4B AI Infrastructure Deal

Crypto mining equities surged across the board after Nebius Group inked a $17.4 billion GPU supply agreement with Microsoft, targeting AI infrastructure expansion. Bitfarms led the charge with a 22% gain, while Cipher Mining climbed 20%. Mid-teen advances rippled through IREN, Hut 8, Riot Platforms, and TeraWulf as investors rewarded companies with scalable computing assets.

The rally occurred despite Bitcoin's 1% dip to $111,100, underscoring a strategic pivot toward AI and data center services. Marathon Digital's muted 4% gain reflected its focus on Bitcoin treasury holdings rather than infrastructure diversification. This divergence signals shifting market priorities as miners adapt to post-halving economics.

Bitcoin Rises As Labor Market Update Alters Economic Outlook

Bitcoin rallied alongside European equities as revised U.S. labor data forced a recalibration of economic expectations. The Bureau of Labor Statistics reported 911,000 fewer jobs created than initially estimated—a revelation that undermines prior optimism about labor market resilience amid inflationary pressures.

Market analysts now debate whether the revisions signal cyclical weakness or structural labor force changes. "These adjustments reflect secular trends in workforce participation more than business cycle positioning," said Action Economics' Michael Englund, suggesting the data may not indicate imminent recession.

The unexpected labor market softening has injected fresh volatility into risk assets. Bitcoin's positive response suggests traders may interpret the cooling jobs market as reducing pressure for restrictive monetary policy—a narrative that could support crypto valuations if economic indicators continue to moderate.

The Bitcoin Standard: Can Crypto Replace Gold — and Who Came Up with the Idea?

Nick Szabo's 1990s concept of Bit Gold laid the groundwork for Bitcoin's emergence as 'digital gold,' a narrative now deeply ingrained in crypto culture. The comparison between Bitcoin and gold persists, with proponents viewing it as a legitimate store of value and skeptics dismissing it as marketing hype.

The scarcity-driven S2F (stock-to-flow) model further fuels the digital gold thesis, drawing parallels to precious metal economics. Yet the question remains: Can a decentralized asset truly replicate gold's millennia-old monetary role, or is this merely a transitional metaphor for an evolving asset class?

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, BTC appears positioned for long-term appreciation. The convergence of institutional adoption, technological infrastructure investment, and growing mainstream acceptance supports a bullish outlook across multiple time horizons.

| Year | Price Prediction Range | Key Drivers |

|---|---|---|

| 2025 | $120,000 - $150,000 | ETF inflows, institutional adoption acceleration |

| 2030 | $250,000 - $400,000 | Global regulatory clarity, corporate treasury standard |

| 2035 | $500,000 - $800,000 | Network effect maturity, store-of-value status |

| 2040 | $1,000,000 - $1,500,000 | Digital gold narrative, global reserve asset status |

BTCC financial analyst Mia emphasizes that these projections assume continued adoption growth and favorable regulatory developments, with short-term volatility expected along the upward trajectory.